My interview with @Mixergy is live. Check it out here: https://mixergy.com/interviews/stranger-studios-with-jason-coleman/

It's great. We cover 15 years of business.

I like getting tactical on podcasts. I know Andrew likes it too. I missed some spots. So here are 5 tips I wish I shared during the interview.

🧵👇

1) During recessions, get close to the money.

I talk a bit about what business was like in 2008. Besides some personal struggles, 2008 was also a time when individuals and businesses were clamping down on spending. So what can you do if you are freelancing through that?

Get close to the money. People will be cutting spending on things that seem superfluous, but any tools, service, or consulting that ties directly to the company's bottom line will be the last to go.

This was part of what encouraged us to focus on membership sites.

I remember some clients we built websites for, even friendly clients (maybe family members ;), saying to me "The website is nice, but it didn't really bring us business."

!!!

We weren't tracking it. The membership sites we helped launched had reporting built in showing $$$.

2) When going up against established competition, don't compete with them head on. Focus your marketing efforts on features and in spaces they aren't addressing.

There were already a couple established membership plugins for WP when PMPro launched.

Making PMPro free and open source was a decision that has lead to better software (what I go into in the interview), but it was also a Judo move to circumvent the competition at the time that was relatively expensive and not OSS.

We didn't waste money to compete with their Google or Facebook ad spend.

We didn't try to recreate the affiliate networks they had already set up.

We focused on becoming the best free membership plugin available on the http://wp.org repository.

3) Speaking of focus. Focus on one project at a time.

When I told Andrew about the frustrations of dealing with 3rd parties changing their APIs when trying to grow WineLog, he asked "Do you have to deal with that kind of thing with PMPro?"

Yes! We do. What's different? Focus.

When Google removed wine from their shopping results, it was the final nail in the coffin for WineLog, as we had just spent months building technology on top of those results.

We didn't have the energy, time, or desire to pivot and try something new.

In business, things are going to fail sometimes. What do you do when you have a set back?

If you have other active projects, you can turn to them for what seems like easier progress.

But if you only have one project to focus on, you HAVE to make it work…

… and you will do what what's needed to try again.

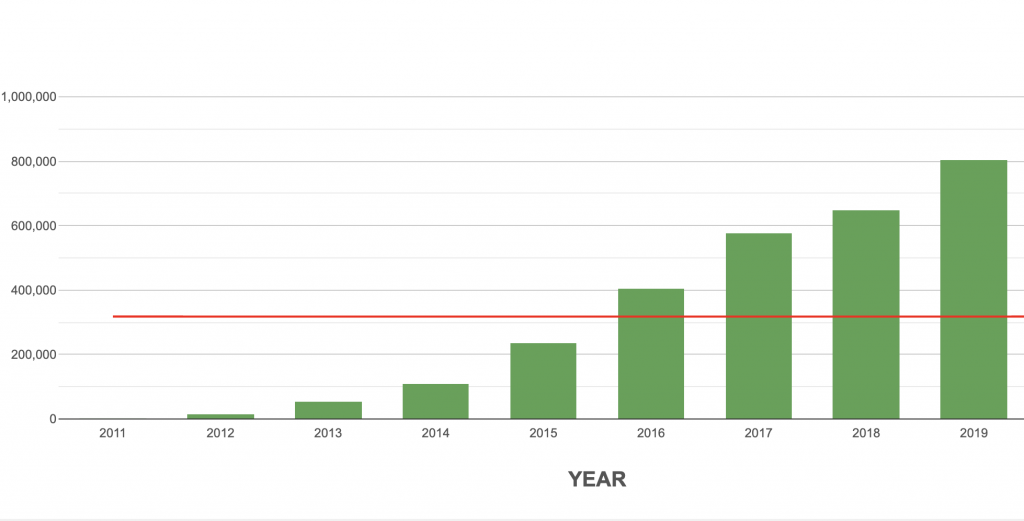

Stopping work on WineLog, InvestorGeeks, and the other side projects we had back around 2010, gave us the time and attention needed to make PMPro a success.

In 2015, we made 80% of our income from making membership sites for others.

When we made the switch from consulting to 100% products-based revenue, we turned down $90k in new work over 3 months to focus on a PMPro relaunch.

The relaunched PMPro 4x'd revenue immediately. Focus.

4) Our Auto-Renewal Checkbox Add On caught Andrew's attention while he scanned our site during the interview.

https://www.paidmembershipspro.com/add-ons/auto-renewal-checkbox-membership-checkout/

I glossed over that one to talk about other add ons, but ARC is pretty cool. The idea behind it is insightful even if you don't use PMPro.

On some sites, customers will purchase a recurring subscription and then CANCEL RIGHT AWAY.

They maybe want access to something right away, but don't really see the benefit in extending membership another month or year.

Auto-Renewal Checkbox tries to address these customers.

ARC gives customers an option at checkout to pay just a one time fee for a membership that expires or to lock into a recurring subscription.

You see this kind of UI all the time when donating online.

However, if you notice this pattern on your site, you should try some things.

Why do your customers only want to pay you one time? Figure that out.

Think about how you could create a separate 1-time-payment product. Maybe your subscription is giving TOO MUCH value, and you should break part of it off into a separate product.

People are really focused on getting recurring revenue on their site. It is nice, but you can find yourself shoehorning what's basically a one-time purchase into a subscription product. Don't force it.

I talk more about timing and pricing here:

5) Finally, I missed a chance to talk about the value of disconnecting.

I said it was easier to step away from work in a products company vs a services company.

Andrew said, "Yeah? What's the longest you stepped away?" Maybe hoping for a great sabbatical story, but I had none.

The longest I've stepped away is 1 or 2 weeks, but I'm definitely able to REALLY get away and disconnect 100% when I go on vacation now. And that is HUGE.

*Every single time* I step away from the day to day of my business for a week, I come back with ideas that grow our business at least 10-20%.

I'd say 4 days in the minimum to really get away. Shoot for 7. More could be better.

If you haven't done that in a while, work it out.

Those are 5 tactical tips that I wish I shared during the interview. You get them for free here on Twitter and my blog. 😀

If you can, watch the interview anyway. Like it on the site. Ask a comment there. It really helps to show Andrew you're listening.

Originally tweeted by Jason Coleman (@jason_coleman) on November 9, 2020.